In an increasingly complex financial world, keeping track of money, expenses, and financial reports has become more important than ever. Whether you’re a small business owner, an entrepreneur, or an individual managing personal finances, a bookkeeper plays a crucial role in ensuring financial stability. A bookkeeper helps streamline financial records, maintain accuracy, and provide insights that contribute to better financial decision-making.

What Does a Bookkeeper Do?

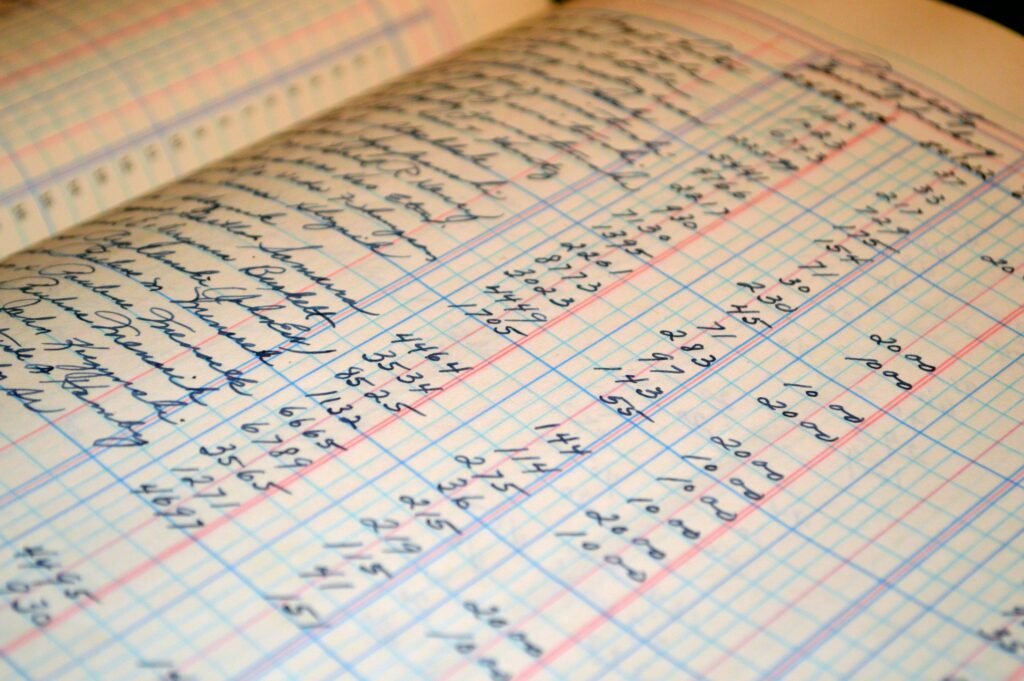

A bookkeeper is responsible for recording, tracking, and organizing financial transactions. They maintain ledgers, track income and expenses, manage invoices, and reconcile bank statements. Unlike accountants, who analyze financial data and prepare reports, a bookkeeper ensures that financial records are accurate and up to date. Their meticulous work allows businesses and individuals to have a clear understanding of their financial standing at any given time.

Why Every Business Needs a Bookkeeper

1. Ensures Accurate Financial Records

One of the primary benefits of hiring a professional for bookkeeping is the accuracy of financial records. Errors in financial data can lead to penalties, missed tax deductions, or cash flow problems. A professional bookkeeper ensures that all transactions are recorded correctly, reducing the risk of costly mistakes.

2. Saves Time and Increases Efficiency

Managing financial records can be time-consuming, especially for business owners focused on growth and operations. A bookkeeper takes over the responsibility of tracking expenses, payroll, and invoices, freeing up valuable time for entrepreneurs to focus on strategic business decisions.

3. Helps with Tax Compliance

Taxes can be complicated, and improper record-keeping can lead to legal issues or audits. A professional ensures that all financial transactions are recorded correctly and categorized appropriately, making tax season much easier. They also help businesses stay compliant with tax laws and avoid penalties.

4. Improves Cash Flow Management

A bookkeeper keeps track of outstanding invoices and ensures that payments are made on time. By managing accounts payable and receivable efficiently, they help improve cash flow, which is essential for the smooth operation of any business.

5. Provides Valuable Financial Insights

Accurate and up-to-date financial records enable business owners to make informed decisions. A bookkeeper provides financial reports that offer insights into revenue trends, expense patterns, and profitability. These insights help businesses make strategic choices that contribute to growth and financial stability.

The Role of a Bookkeeper in Personal Finances

While businesses greatly benefit from the expertise of a professional, individuals managing their personal finances can also find value in their services. Also, a bookkeeper can help track expenses, manage budgets, and ensure that financial goals are met. For individuals with multiple income sources, investments, or rental properties, having a bookkeeper can simplify financial management and provide a clearer picture of financial health.

Conclusion

In today’s financial landscape, the role of a bookkeeper is more important than ever. They provide accuracy, save time, ensure tax compliance, improve cash flow, and offer valuable financial insights. Whether for a business or personal finances, a professional is an essential asset in maintaining financial stability and achieving long-term success. Hiring a professional bookkeeper can make a significant difference in managing finances effectively and avoiding costly mistakes.