Stay Updated By Exploring Further Our Blog

Blog & Articles

Why Smart Financial Management Is the Key to Business Success

Running a business is more than making sales. Behind every profitable company is a clear financial system that supports growth, stability, and informed decision-making. Yet

Why Bookkeeping Mistakes Are Silently Hurting Small Businesses

Most small businesses don’t fail because of bad products or lack of customers, they fail because they don’t manage their finances properly. The biggest issue?

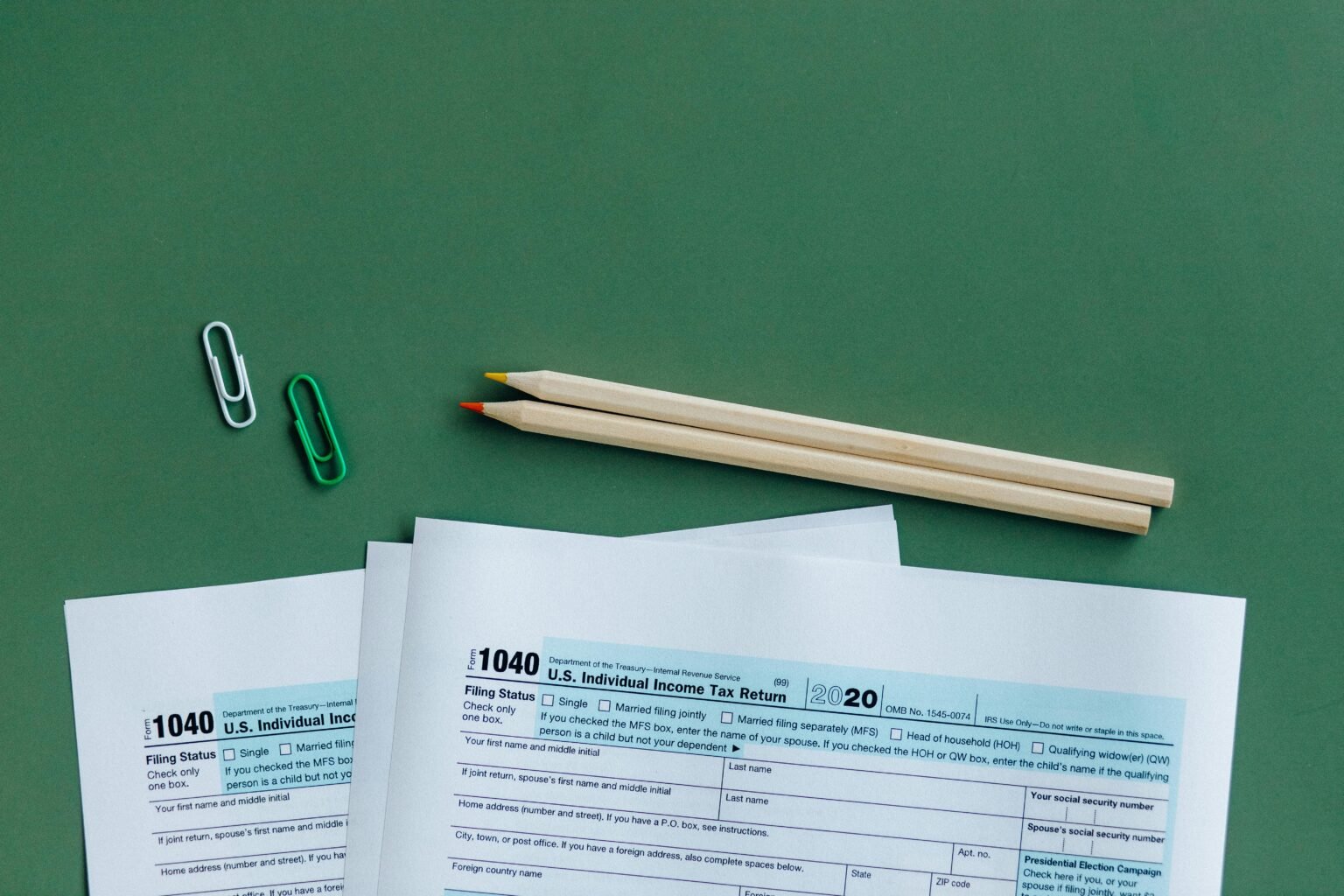

What Small Business Owners Need to Know About Hidden Tax Savings

Running a small business is challenging, with daily decisions impacting your operations, cash flow, and profitability. Yet, one area often overlooked is hidden tax savings

Hidden Tax Savings Every Small Business Owner Should Know

Running a small business means juggling operations, cash flow, customers, and decisions that directly affect your bottom line. But there’s one area where most business

How Freelancers & Small Business Owners Can Master Cash Flow for Growth

Introduction Managing money is one of the biggest challenges for freelancers and small business owners. Even profitable businesses can struggle if cash flow isn’t managed

5 Proven Ways Smart Accounting Boosts Profitability for Local Businesses

Running a business today means balancing speed, precision, and financial clarity. Whether you own a café in downtown Tacoma or manage a construction firm in

Move Fast. Stay Ahead: How Smart Accounting Fuels Local Business Growth

In today’s fast-changing world of business, speed and clarity have become essential. Whether you’re running a cozy café, managing an online store, or offering professional

S Corporation Compliance for Remote Teams and Digital Nomads

The rise of remote work and digital nomadism has transformed how businesses operate. For S Corporations, this shift introduces new challenges in maintaining legal and

S Corporation Health Benefits: What You Can Deduct and What You Can’t

Health benefits are a vital part of financial planning for business owners, especially those operating under an S Corporation structure. While S Corporations offer tax

Using S Corporation Distributions to Fund Real Estate Investments

For business owners operating under an S Corporation structure, distributions offer a tax-efficient way to access profits. Unlike salaries, which are subject to payroll taxes,